Medicare tax calculation 2023

The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. The wage base limit is the maximum wage thats subject to the tax for that year.

2023 Social Security Cola Could See Significant Increase Alongside Inflation Benefitspro

2 days agoBased on inflation through August we calculate that the COLA for August 2023 has fallen short on average by 48 she added.

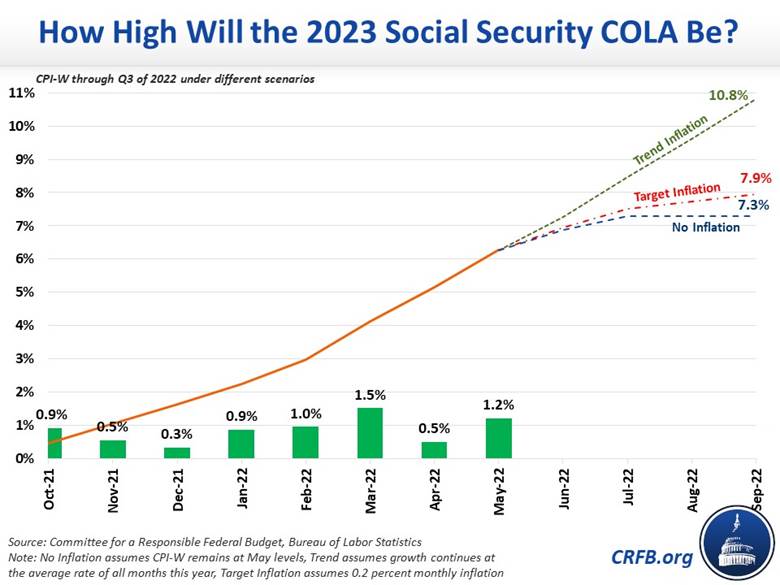

. Calculate Your 2023 Tax Refund. The increase is based on a calculation that compares the average consumer-price index from the third quarter of 2022 with data from the same period last year. 1 day agoThe groups latest COLA estimate is well below earlier estimates this year estimates that projected a Social Security increase as high as 105 in 2023.

2023082 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2022 tax return and tax refund calculations. Calculate Additional Medicare Tax on any wages in excess of the applicable threshold for the filing status without regard to whether any tax was withheld. 2021 Tax Calculator Exit.

It will be updated with 2023 tax year data as soon the data is available from the IRS. Prepare and e-File your. 6 rows Remember the income on your 2020 tax return AGI plus muni interest determines the IRMAA you pay.

Prepare and e-File your. While awaiting the official. People who owe this.

For earnings in 2022 this base is 147000. Estimate my Medicare eligibility premium. As you begin the process of filing 2021 taxes you should be aware that what goes on a completed Form 1040 will have an impact on what premiums you will be paying in 2023.

This Tax Return and Refund Estimator is currently based on 2022 tax tables. A 1656 benefit is short about 4380 per month. Based on the Information you entered on this 2021 Tax Calculator you.

The Medicare Tax is an additional 09 in tax an individual or couple must pay on income thresholds above 200000 for singles and 250000 for couples. Calculate Your 2023 Tax Refund. On August 16 2022 President Biden signed into law the Inflation Reduction Act of 2022 which includes a broad package of health tax and climate change provisions.

13 hours agoThe Senior Citizens League TSCL has revised its estimate for the 2023 COLA and has reduced it from its earlier 96 to 87 which would still be the largest increase in. It will be updated with 2023 tax year data as soon the data is available from the IRS. Self-employed people are allowed to deduct their health insurance premiums on Schedule 1 of the 1040 form as an above the line.

Refer to Whats New in Publication 15 for the. This Tax Return and Refund Estimator is currently based on 2022 tax tables. The 202301k after tax calculation includes certain defaults to provide a standard tax calculation for example the State of Washington is used for calculating state taxes due.

This calculator includes the additional 09 Medicare tax on Social Security wages and self-employment income in excess of a threshold based on your tax-filing status. Please note that the self-employment tax is 124 for the Federal Insurance Contributions Act FICA portion and 29 for Medicare. Rising inflation coupled with a 145 Medicare Part B premium increase from 2021 to 2022 raises concerns about Medicare premiums in 2023.

What is a 202308k after tax. Heres what you need to know. Medicare tax calculator 2023 Jumat 09 September 2022 This calculator includes the 38 Medicare contribution tax on the lesser of a net investment income or b modified.

The FICA portion funds Social Security which provides.

Social Security What Is The Wage Base For 2023 Gobankingrates

Proposed Law Impact On Social Security Taxable Wage Base Isdaner Company

Could 2023 Social Security Cola Hit 9 Benefitspro

Form 941 For 2023

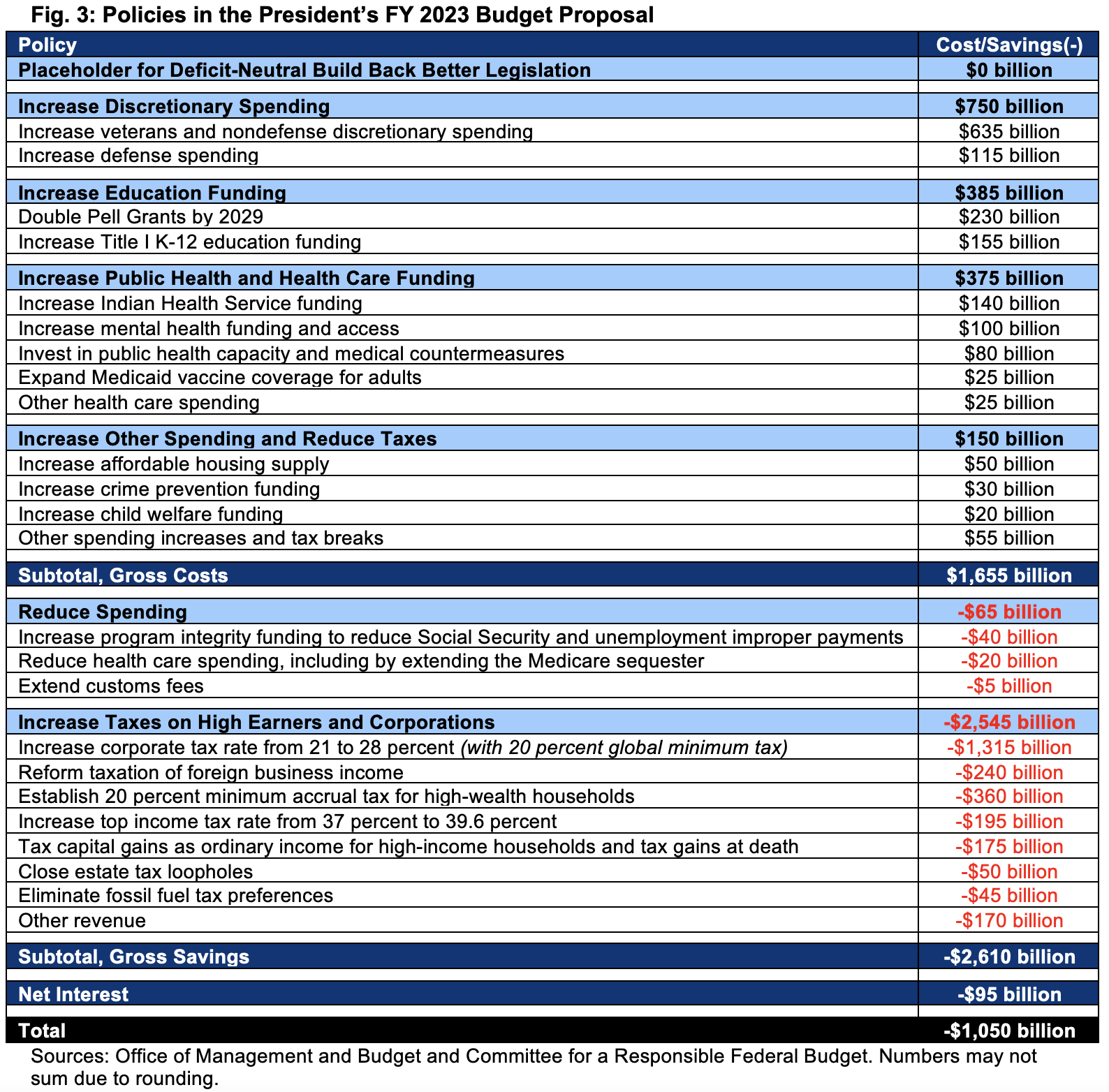

Analysis Of The President S Fy 2023 Budget Committee For A Responsible Federal Budget

Calendar Year 2023 Medicare Physician Fee Schedule Proposed Rule Part 2 Youtube

941 Form 2023

What Is The Maximum Taxable Income For Social Security For 2023 Gobankingrates

2022 Wage Cap Jumps To 147 000 For Social Security Payroll Taxes

2023 Health Savings Accounts Limits Are Released By The Irs Calcpa Health Trusted Health Plans For Cpas

Medicare Part B Premiums For 2022 Jump By 14 5 From This Year Far Above The Estimated Rise In Cost Medicare Tax Brackets Required Minimum Distribution

Moaa Here S Why Your Medicare Part B Costs May Drop In 2023

You Won T Believe The Size Of This 2023 Social Security Cola Estimate 401 K Specialist

Medicare And Taxes How Your 2023 Medicare Premiums Are Affected By Your 2021 Tax Filing Gobankingrates

2023 San Francisco Hcso Expenditure Rates Released

Biden S 5 79 Trillion 2023 Budget Proposal Would Also Expand Regulation

My First Million By 16th October 2023 How To Get Money Credit Card App Business Travel Outfits